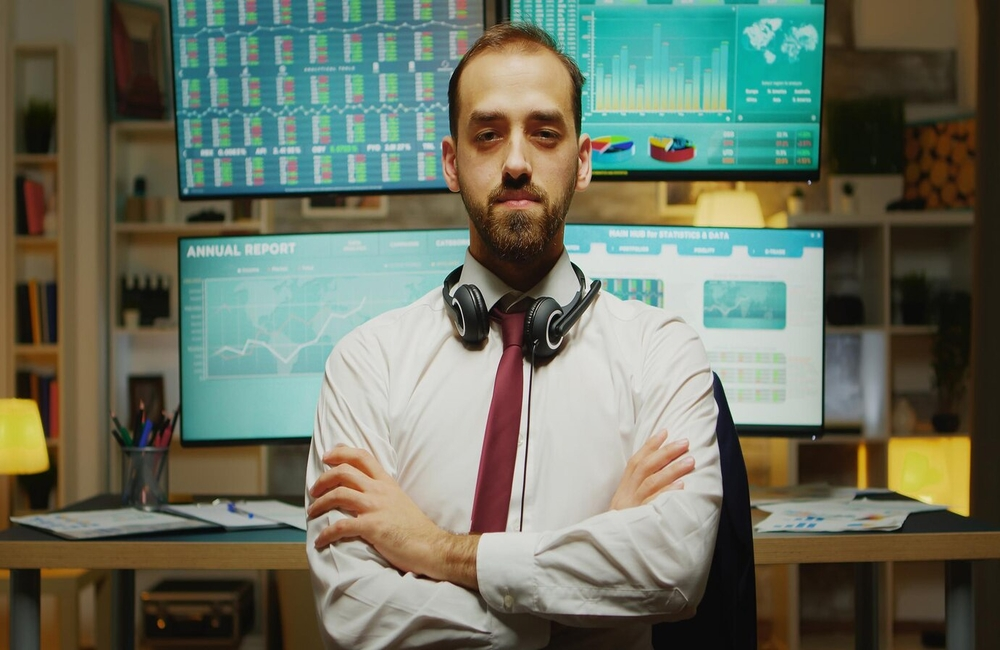

For financial advisors and investors alike, understanding UK mortgage bonds is crucial to leveraging opportunities and managing risks in today’s economy. This article explores their structure, performance, and driving factors.

What Are Mortgage Bonds?

Mortgage bonds are debt securities backed by pooled home loans. Investors receive interest and principal payments drawn from underlying mortgage repayments.

They include residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS), depending on the collateral.

The Structure of UK Mortgage Bonds

UK securitisations are dominated by RMBS issued by banks and building societies. Bonds are divided into tranches—senior (lower risk) and mezzanine/junior (higher risk and yield).

They may include fixed-rate and variable-rate loan portfolios to cater to diverse investor appetites.

Key Drivers of Demand and Supply

Interest Rates

The Bank of England’s rate changes shape bond yields and risk-return profiles for mortgage bonds.

Housing Market Trends

Property price movements affect collateral values, while affordability and lending standards influence issuance volumes.

Investor Sentiment

Perceptions of UK credit quality and market stability drive demand, despite periodic disruptions like Brexit.

Risks in the UK Mortgage Bond Market

Credit Risk

Borrower defaults can impair payments, linked to employment levels and economic confidence.

Interest Rate Risk

Rising rates can depress bond prices, especially for variable-rate tranches.

Prepayment Risk

Early loan repayments during rate falls shorten bond duration and reduce expected returns.

Emerging Trends in the UK Mortgage Bond Landscape

ECBC and Green Securitisation

Frameworks for green RMBS backed by energy-efficient properties are gaining momentum.

Technological Advancements

Blockchain and advanced analytics are enhancing transparency, monitoring and liquidity.

Economic Uncertainty and Resilience

Despite rate hikes and volatility, institutional demand for yield-bearing assets remains strong.

Why Mortgage Bonds Remain Relevant

With stable cash flows and tranche flexibility, mortgage bonds offer diversification and potential downside protection for portfolios.

A Tailored Approach to Navigating Mortgage Bonds

At Advisor’s Gateway, we deliver personalised strategies—from senior RMBS for stability to mezzanine bonds for higher yields—to align with your goals. Contact us to explore how mortgage bonds can strengthen your portfolio.