ASX futures were 21 points or 0.29% lower as of 8:00am on Monday, suggesting a dip at the open. US stock and government bond markets were closed on Monday to mark Martin Luther King Jr. Day. Major US indices have made a strong start to 2023, with the S&P 500 gaining 4.2% to start the year. Evidence of cooling inflation has convinced some investors that markets have already endured the brunt of the Federal Reserve's interest rate increases, giving some market participants confidence to begin buying riskier assets. Still, risks loom for financial markets. Many economists still expect higher interest rates to push the US economy into a recession in the coming year. Business and academic economists polled recently by The Wall Street Journal put the probability of a recession in the next 12 months at 61%, little changed from 63% in October's survey.

In commodity markets, Brent crude oil dipped 1.29% to $US84.18 a barrel while gold lost 0.22% to US$1,916.00. In local bond markets, the yields on 2 Year and 10 Year government bonds were both unchanged at 3.15% and 3.59%, respectively. In the US, the yield on 2 Year Treasury notes edged up to 4.23% and the yield on 10 Year Treasury notes rose to 3.50%. The Australian dollar edged down to 69.54 US cents from its previous close of 69.74.

Asia

Chinese shares extended early gains to finish higher, buoyed by positive sentiment after state media reports said that twenty-nine of China's thirty-one provinces have announced annual economic growth targets of at least 5% for 2023. The benchmark Shanghai Composite Index gained 1.0% to 3227.59, the Shenzhen Composite Index rose 1.3% to 2094.99 and the ChiNext Price Index added 1.9% to 2539.52. Chinese liquor stocks led the gainers, with Kweichow Moutai rising 1.4% and Wuliangye Yibin advancing 4.0%. Zoomlion Heavy's A shares added 1.6% following news of its plans to spin off and list a unit that manufactures mini lifting equipment.

Hong Kong's benchmark Hang Seng Index ended flat at 21746.72, putting a pause to its beginning-of-year rally. The index underperformed regional markets. Investors are closely watching China’s Q4 GDP, set for release on Tuesday, with economists polled by WSJ putting growth at 1.7%, slower than last year’s 3.9%. Consumption-related companies and the tech sector led the laggards. The Hang Seng Tech Index dropped 1.1%, following the sector's losses on Wall Street on Friday, with Lenovo declining 4.0% and Meituan 3.3% lower. Financial stocks outperformed the market, with Citic increasing 1.6% and China Merchants Bank rising 2.1% after it released its 2022 earnings Friday.

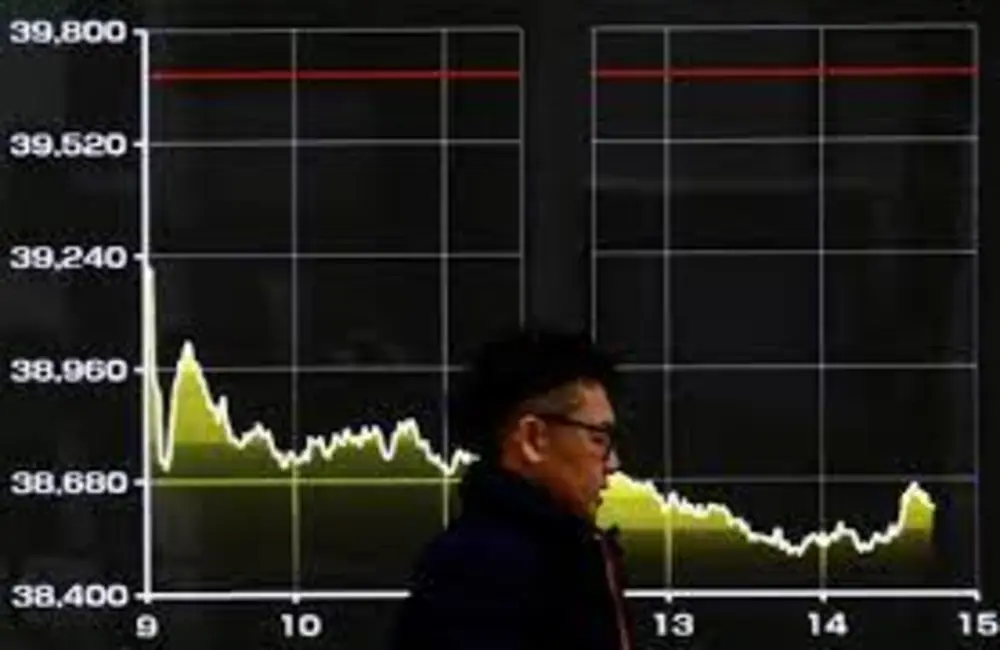

The Nikkei Stock Average closed 1.1% lower at 25822.32, ahead of the Bank of Japan's two-day policy meeting starting today. Auto stocks were broadly lower, with Nissan Motor down 1.7%, Honda Motor 1.0% lower and Toyota Motor up 0.1%. Among financial shares, Mitsubishi UFJ Financial Group fell 2.9% and Sumitomo Mitsui Financial Group declined 2.8%.

Europe

Europe's major stock markets rose on Monday as gains for property and construction shares outpaced losses for food delivery firms and financial stocks. The pan-European Stoxx Europe 600 rose 0.50%, the French CAC 40 added 0.28%, the German DAX advanced 0.31%, and Great Britain’s FTSE 100 gained 0.20%. LEG Immobilien, Inmobiliaria Colonial, Segro and Taylor Wimpey were among the biggest pan-European risers, while HelloFresh, Just Eat Takeaway.com, Admiral and DNB Bank were among the biggest losers in food delivery, banking, and insurance. IG analysts commented that "Asian stocks held steady as the new week began, but a US holiday means overall market activity will remain circumscribed.”

UK household cashflow projections are giving signs of improvement for 2023, supported by a robust employment backdrop, lower energy prices and fuel costs, RBC Capital Markets analysts said in a note. The consumer backdrop is projected to ease by late 2023, with energy prices expected to fall from spring, which is likely to reflect in consumer spending and retailer earnings in 2024, they said. "In contrast to the 2008-09 financial crisis, the labour market remains strong, with significant wage inflation, particularly at the younger end of the age spectrum," they commented, adding that "this is supportive for our positive stance on UK retailers such as NEXT and WH Smith.”

North America

US stock and government bond markets were closed Monday to mark Martin Luther King Jr. Day. Major US indices have made a strong start to 2023, with the S&P 500 gaining 4.2% to start the year. Evidence of cooling inflation has convinced some investors that markets have already endured the brunt of the Federal Reserve's interest rate increases, giving some market participants confidence to begin buying riskier assets. Still, risks loom for financial markets. Many economists still expect higher interest rates to push the US economy into a recession in the coming year. Business and academic economists polled recently by The Wall Street Journal put the probability of a recession in the next 12 months at 61%, little changed from 63% in October's survey.

Another concern, some market watchers say, is the growing disconnect between Fed communications and what investors anticipate it might do this year. Fed officials have indicated that they will continue raising interest rates in case price pressures prove more persistent. Some investors, however, expect the central bank to reverse course and begin easing monetary policy later this year. "It's an impasse," said Altaf Kassam, head of investment strategy and research for Europe, the Middle East and Africa at State Street Global Advisors. "The market reckons the Fed will blink because economic conditions are worsening to an extent that they would have to stop raising rates and even cut rates to avoid a hard landing. But the Fed has repeatedly said, 'Read my lips, no rate cuts.'"

This week will bring results from Goldman Sachs and Morgan Stanley, as well as other corporate heavyweights such as Netflix and United Airlines. Investors will also be eyeing updates from the World Economic Forum, the annual gathering of global executives, world leaders, and billionaires in Davos, Switzerland.