ASX futures were 14 points or 0.19% higher as of 8:00am on Wednesday, pointing to a climb at the open. US stock indices wobbled today, following sharply lower earnings from two of the largest investment banks and Chinese data that showed a near-historic slowdown in economic growth. The S&P 500 fell 0.20% while the Nasdaq Composite edged up 0.14%. The Dow Jones Industrial Average retreated 1.14%, or about 390 points, weighed down by declines in shares of Goldman Sachs Group and property-and-casualty insurer Travelers.

Stocks have started the year strong, with investors positioning for easing inflation that could drive a shift in central bank policy. The Federal Reserve aggressively raised interest rates in 2022 to tame inflation, rattling stocks and bonds alike. The S&P 500 is up more than 4% so far this year, and investors are looking for signs the rally can continue.

In commodity markets, Brent crude oil gained 2.66% to $US86.71 a barrel while gold edged down 0.38% to US$1,908.77. In local bond markets, the yield on Australian 2 Year government bonds dipped to 3.14% while the 10 Year edged up to 3.60%. Overseas, the yield on 2 Year US Treasury notes climbed to 4.19% and the yield on 10 Year US Treasury notes increased to 3.54%. The Australian dollar climbed to 69.83 US cents from its previous close of 69.53. The Wall Street Journal Dollar Index, which tracks the US dollar against 16 other currencies, edged down to 95.22.

Asia

Chinese shares closed mixed after the release of Q4 and 2022 GDP data earlier today, which signaled that the economy may have bottomed out. China's economy went sideways in Q4 and "it was a disappointing end to 2022 for the country, whose economy mustered full-year growth of just 3%," said Harry Murphy Cruise at Moody's in a note to clients. Chip makers and securities firms led today’s gainers, with both Citic Securities and SMIC adding 0.4%. Pharmaceutical companies, telecommunications, and consumer companies fell. China Telecom dropped 1.2% and WuXi AppTec declined 2.6%. The Shanghai Composite Index ended 0.1% lower at 3224.24, the Shenzhen Composite Index closed flat, and the ChiNext Price Index rose 0.2%.

Hong Kong shares finished lower as China released better-than-expected Q4 GDP data. “Investors view the beat as dashing hopes of People’s Bank of China rate cuts that would significantly enhance the growth outlook. Hence the all-things-China rally is losing a bit of steam," Stephen Innes, managing partner at SPI Asset Management, said in a note. The benchmark Hang Seng Index was 0.8% lower at 21577.64, dragged by tech and consumer companies. Chow Tai Fook Jewelry declined 1.9% and Wuxi Biologics dropped 6.1%, as its major shareholder plans to sell shares in a block trade. China Hongqiao Group and Tencent were among gainers, rising 2.5% and 1.4%, respectively.

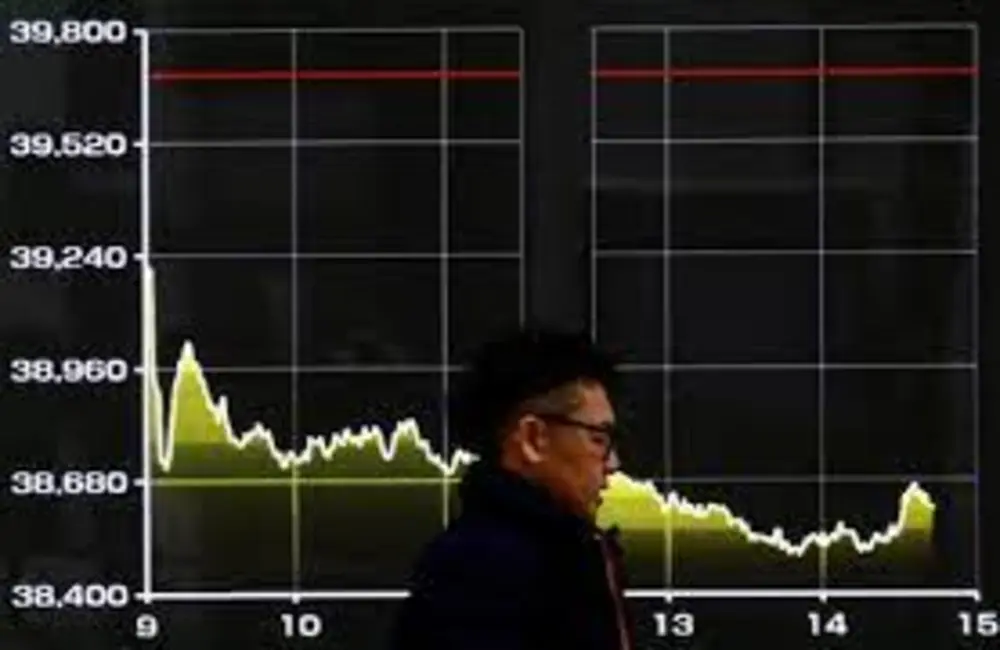

Japanese stocks ended higher, led by gains in auto and electronics shares, as the yen's recent strength, which clouded the earnings outlook, has eased for now. Car manufacturer Subaru Corp. gained 2.5% and Murata Manufacturing climbed 3.1%. The Nikkei Stock Average rose 1.2% to 26138.68.

India's benchmark Sensex index closed 0.94% higher at 60655.72. Corporate earnings are likely to remain in focus for investors amid thin trading volumes, as US markets were closed Monday for the Martin Luther King Jr. Day holiday. Today’s gainers included Larsen & Toubro, which closed 3.5% higher, while Hindu Unilever added 2.7% and Housing Development Finance Corp. rose 1.8%. Decliners included State Bank of India, which closed 1.7% lower.

Europe

European stocks rose today, as the pan-European Stoxx Europe 600 index closed 0.31% higher. The French CAC 40 index increased 0.48%, the German DAX added 0.35%, and Great Britain’s FTSE 100 index dropped 0.12%. Among Stoxx Europe 600 constituents, media and entertainment company Viaplay Group AB Series B saw the largest increase, as shares gained 6.1%. Shares of aerospace and defense firm Leonardo S.p.A. and health care company Recordati S.p.A. gained 4.9% and 4.4%, respectively.

Shares of retail company THG PLC saw the largest drop among Stoxx Europe 600 constituents, as shares plummeted 21.4% on Tuesday. Shares of retail firm Ocado Group PLC and health care company Koninklijke Philips N.V. declined 9.3% and 6.2%, respectively. BELIMO Holding AG, an industrial goods company, and technology firm Sinch AB rounded out the top five largest decreases as their stocks fell 6.2% and 5.6%, respectively.

North America

US stock indices wobbled today, following sharply lower earnings from two of the largest investment banks and Chinese data that showed a near-historic slowdown in economic growth. The S&P 500 fell 0.20% while the Nasdaq Composite edged up 0.14%. The Dow Jones Industrial Average retreated 1.14%, or about 390 points, weighed down by declines in shares of Goldman Sachs Group and property-and-casualty insurer Travelers.

Stocks have started the year strong, with investors positioning for easing inflation that could drive a shift in central bank policy. The Federal Reserve aggressively raised interest rates in 2022 to tame inflation, rattling stocks and bonds alike. The S&P 500 is up more than 4% so far this year, and investors are looking for signs the rally can continue.

"I'm pretty optimistic that we can continue to climb the wall of worry because everybody was so pessimistic," said Sandy Villere, portfolio manager with Villere & Co. Mr. Villere recommended investors shift into growth stocks instead of defensive companies because he expects the Fed to stop raising interest rates soon. He's buying shares of small-cap growth companies, he said.

In earnings-related news, Goldman Sachs and Morgan Stanley both noted sharply lower fourth-quarter profits, owing to a substantial slowdown in deal making. Goldman's shares fell 7.3% after it missed Wall Street's earnings estimates, on pace to be the worst performer in the Dow. Morgan Stanley stock rose 7.4%, after revenue and profit beat expectations.

A series of other major banks including JPMorgan reported earnings on Friday. Collectively, they have put aside billions of dollars in loan-loss provisions in anticipation of a recession. Some investors, however, aren't convinced a deep recession is imminent. "The likelihood of a recession is lower than people are expecting," said Jonathan Golub, a research analyst at Credit Suisse, who noted that inflation is slowing, earnings are beating projections, wages are rising, and consumer spending remains strong. Although earnings season has just started, more than 70% of the companies that have reported have beat projections, according to analysis through Friday by Mr. Golub.