Berkshire Hathaway (BRK.A) chairman Warren Buffett released his annual letter to shareholders, along with the company's 2023 earnings, on Feb. 24.

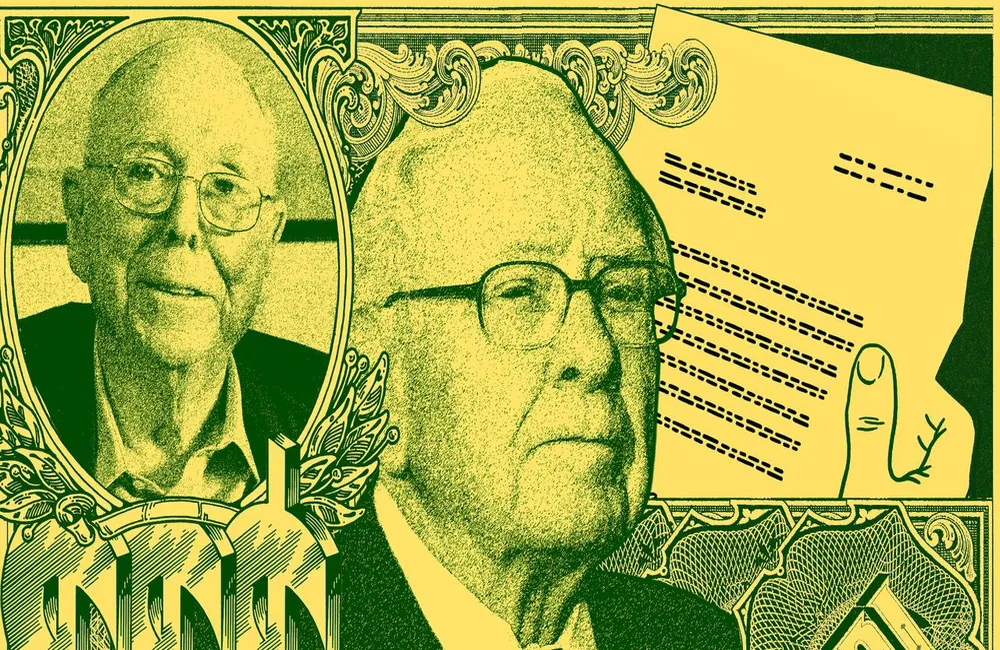

This is Buffett’s first shareholder letter since the death of longtime investment partner Charlie Munger in late November 2023.

As in prior years, Buffett’s 2023 shareholder letter is less about “what’s new” and more about offering investors useful reminders about how to invest successfully—expressed in Buffett’s unique, folksy way. Yet there are some notable comments in this year’s letter about whether Berkshire will pay a dividend, who Buffett’s successor will be, and which stocks Buffett expects to be long-term holdings.

Highlights from the 2023 Shareholder Letter

Warren Buffett on Charlie Munger: ‘The Architect’

In a separate note to readers before the shareholder letter begins, Buffett pays tribute to Munger. Long credited for pivoting Buffett (and subsequently Berkshire) toward quality companies, Buffett calls Munger the “architect” of present Berkshire, with Buffett acting as the “general contractor” who carried out Munger’s vision.

According to Buffett, Munger told him in 1965:

"Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale."

Buffett on How to Invest

Plenty of ink has been spilled from the pens of the financial press about how to invest like Warren Buffett. But there’s nothing like hearing an annual reminder from the Oracle of Omaha himself about how to build a portfolio to last—especially in today’s market climate.

“Though the stock market is massively larger than it was in our early days, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.”

Buffett reiterates some of the principles that have made Berkshire successful over time:

- Have a clarity of purpose when investing.

- Focus on quality investments—or in Buffett's words, "wonderful businesses."

- Favor companies run by good managers.

- Hold on for the long term, as "patience pays."

- Practice "fiscal conservatism."

Warren Buffett Won’t Sell These Stocks

Buffett reiterated his confidence in long-term holdings like Coca-Cola (NYSE: KO) and American Express (NYSE: AXP), both of which Berkshire maintained in 2023.

“When you find a truly wonderful business, stick with it,” he writes. “Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable.”

He also highlighted two other “Rip Van Winkle” investments:

- Occidental Petroleum (NYSE: OXY): Berkshire owned 27.8% of the company at the end of 2023 and holds warrants to increase its stake. Berkshire appreciates the company's U.S. oil and gas holdings and carbon-capture leadership.

- Five Large Japanese Conglomerates: Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. Berkshire owns about 9% of each and pledges not to exceed 9.9%. Buffett praises their shareholder-friendly management practices.

Buffett also hints these investments may lead to global partnership opportunities.

Can Berkshire Hathaway Outperform?

Buffett addressed the question of whether Berkshire can continue to outperform:

“There remains only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.”

So what can investors expect? Buffett says Berkshire will likely do slightly better than the average company.